Introduction

In the past decade, a revolutionary form of money has emerged, challenging traditional financial systems and reshaping the way we think about transactions—cryptocurrency. Whether you have heard of Bitcoin, Ethereum, or Dogecoin, the concept of digital money is gaining traction worldwide. But what exactly is cryptocurrency, and how does it work? This guide will break everything down in simple terms, making it easy for beginners to grasp this evolving technology.

1. Understanding Cryptocurrency

As digital technology continues to evolve, so does the way we perceive and use money. Cryptocurrency has emerged as a revolutionary form of digital finance, challenging traditional banking systems and offering new ways to transact, invest, and store value. But what exactly is cryptocurrency, and why is it significant?

1.1 What is Cryptocurrency?

Cryptocurrency is a form of digital or virtual money that relies on cryptographic techniques to secure transactions and regulate the creation of new units. Unlike traditional currencies such as the U.S. dollar, Euro, or Japanese yen—issued and controlled by governments and central banks—cryptocurrencies operate on decentralized networks, often powered by blockchain technology.

Key Characteristics of Cryptocurrency

- Decentralized – No single authority, such as a central bank or government, controls its supply or operation. Instead, cryptocurrencies function on distributed networks maintained by a community of users.

- Secure – Transactions are encrypted and recorded on a public ledger (blockchain), making them nearly impossible to alter or counterfeit.

- Transparent – Every transaction is permanently recorded on the blockchain, ensuring transparency and preventing fraud.

- Anonymous (or Pseudonymous) – Users can transact without revealing their real identities. While transactions are recorded on the blockchain, they are linked to digital wallet addresses rather than personal details.

- Globally Accessible – Cryptocurrency transactions can occur across borders without the need for banks or payment processors, making them an attractive alternative for international transfers and financial inclusion.

How Does Cryptocurrency Work?

To better understand cryptocurrency, it is essential to break down its key components:

- Blockchain Technology – A blockchain is a decentralized digital ledger that records all transactions in a secure and transparent manner. Each transaction is grouped into a “block,” and once verified, it is added to the “chain” of previous transactions. This technology ensures that no single party can alter the transaction history.

- Cryptographic Security – Cryptocurrencies use cryptographic methods (such as hashing and encryption) to secure transactions and user data. This makes it extremely difficult for hackers to manipulate the system.

- Mining & Validation – Some cryptocurrencies, like Bitcoin, rely on a process called “mining,” where powerful computers solve complex mathematical problems to validate transactions and add them to the blockchain. Other cryptocurrencies use different methods, such as Proof of Stake (PoS), to confirm transactions more efficiently.

- Wallets & Private Keys – Unlike traditional bank accounts, cryptocurrency is stored in digital wallets. Each wallet has a public key (like an account number) and a private key (like a password). The private key must be kept secure because it grants access to your funds.

Why Was Cryptocurrency Created?

Cryptocurrency was initially designed to provide an alternative to the traditional financial system, which relies on banks and intermediaries. The idea gained traction after the 2008 global financial crisis when trust in centralized financial institutions was at an all-time low.

Bitcoin, the first cryptocurrency, was introduced in 2009 by an anonymous individual or group known as Satoshi Nakamoto. It aimed to create a peer-to-peer electronic cash system that would allow individuals to send and receive payments without the need for banks. Since then, thousands of cryptocurrencies have emerged, each with unique features and use cases.

Examples of Popular Cryptocurrencies

While Bitcoin remains the most well-known cryptocurrency, several others have gained popularity over the years, including:

| Cryptocurrency | Year Launched | Key Features | Use Cases |

|---|---|---|---|

| Bitcoin (BTC) | 2009 | First and most valuable cryptocurrency | Digital gold, store of value, transactions |

| Ethereum (ETH) | 2015 | Smart contract functionality | Decentralized apps (DApps), NFTs, DeFi |

| Binance Coin (BNB) | 2017 | Used on Binance Exchange | Trading discounts, transaction fees |

| Cardano (ADA) | 2017 | Energy-efficient blockchain | Smart contracts, staking |

| Ripple (XRP) | 2012 | Fast and low-cost cross-border payments | Banking and remittances |

| Tether (USDT) | 2014 | Stablecoin pegged to USD | Reducing volatility, trading |

Cryptocurrency has revolutionized digital finance by providing a secure, transparent, and decentralized way to transfer value. As more businesses, investors, and individuals explore its potential, it is clear that cryptocurrency is more than just digital money—it represents a major shift in the global financial landscape.

2. How Cryptocurrency Works

Cryptocurrency is built on innovative technology that ensures security, transparency, and decentralization. Unlike traditional financial systems that rely on banks and intermediaries, cryptocurrencies operate on a peer-to-peer network, allowing users to send and receive funds without the need for third-party approval.

2.1 Blockchain Technology Explained

At the core of cryptocurrency is blockchain technology—a decentralized and distributed ledger that records transactions in a secure and transparent manner. This technology eliminates the need for central authorities like banks, ensuring that transactions remain tamper-proof and publicly verifiable.

How Blockchain Works

- Transaction Initiation – A user initiates a transaction by sending cryptocurrency from their wallet to another user.

- Broadcasting to the Network – The transaction is broadcasted to a decentralized network of nodes (computers) for verification.

- Validation by Nodes – Miners or validators confirm the transaction using cryptographic algorithms. Depending on the blockchain, this can be done through Proof of Work (PoW) (e.g., Bitcoin) or Proof of Stake (PoS) (e.g., Ethereum 2.0).

- Transaction Grouping – Once validated, the transaction is combined with others into a block.

- Block Addition to the Chain – The newly created block is added to the existing blockchain, making the transaction immutable and irreversible.

- Completion – The transaction is confirmed, and the recipient receives the cryptocurrency.

Benefits of Blockchain

- Security – Transactions are encrypted and stored across multiple nodes, reducing the risk of fraud and hacking.

- Transparency – The public ledger allows anyone to verify transactions, increasing trust in the system.

- Decentralization – No single entity controls the blockchain, preventing censorship or manipulation.

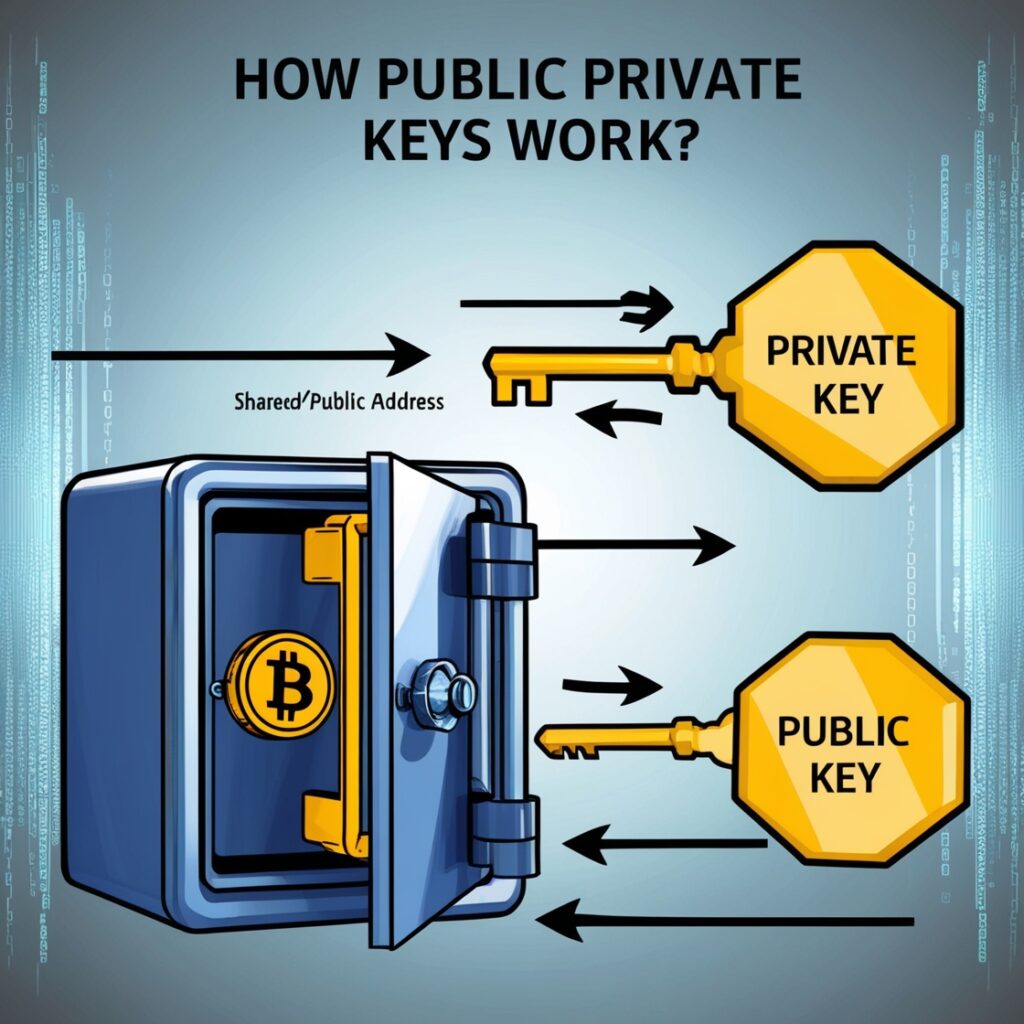

2.2 Public and Private Keys: How Transactions Work

Unlike traditional banking systems, which rely on account numbers and passwords, cryptocurrency transactions use cryptographic keys for security and ownership verification.

Understanding Public and Private Keys

- Public Key – A unique, wallet-specific address visible to others. It functions like a bank account number, allowing users to receive cryptocurrency.

- Private Key – A confidential, encrypted code that grants access to a user’s cryptocurrency holdings. It acts as a digital signature, authorizing transactions.

Importance of Private Key Security

Losing access to a private key means losing access to funds, as cryptocurrency transactions are irreversible. To prevent loss or theft, users store private keys in hardware wallets, software wallets, or even offline (cold storage).

2.3 Different Types of Cryptocurrencies

While Bitcoin was the first cryptocurrency, thousands of digital assets now exist, each serving different purposes. Here are the main categories of cryptocurrencies:

2.3.1 Bitcoin (BTC)

- The first and most widely recognized cryptocurrency, created in 2009 by Satoshi Nakamoto.

- Often referred to as “digital gold” due to its limited supply of 21 million coins.

- Primarily used as a store of value and medium of exchange.

2.3.2 Ethereum (ETH)

- Introduced in 2015 by Vitalik Buterin, Ethereum is more than just a digital currency.

- It enables smart contracts and decentralized applications (DApps).

- The Ether (ETH) token is used for transaction fees and network operations.

2.3.3 Stablecoins

- Designed to reduce price volatility by being pegged to real-world assets like fiat currencies or gold.

- Common stablecoins include:

- Tether (USDT) – Pegged to the U.S. dollar, widely used in trading.

- USD Coin (USDC) – Backed by U.S. dollar reserves, ensuring 1:1 value stability.

- Dai (DAI) – Uses smart contracts to maintain its stability, unlike fiat-backed stablecoins.

2.3.4 Privacy Coins

- Focus on anonymous transactions by concealing sender, receiver, and transaction amounts.

- Common examples:

- Monero (XMR) – Uses ring signatures and stealth addresses for enhanced privacy.

- Zcash (ZEC) – Offers optional zero-knowledge proofs to mask transaction details.

2.3.5 Meme Coins

- Inspired by internet culture and often fueled by community hype.

- Examples include:

- Dogecoin (DOGE) – Created as a joke but gained widespread adoption, partly due to Elon Musk’s endorsements.

- Shiba Inu (SHIB) – Dubbed the “Dogecoin killer,” operating on the Ethereum blockchain.

2.3.6 Utility Tokens

- Designed to serve specific purposes within a blockchain ecosystem.

- Examples include:

- Binance Coin (BNB) – Originally created for discounted trading fees on Binance but now used for DeFi, NFTs, and payments.

- Chainlink (LINK) – Connects smart contracts with real-world data, enabling decentralized applications.

2.3.7 Governance Tokens

- Allow holders to participate in decision-making within decentralized platforms.

- Examples include:

- Uniswap (UNI) – Gives users voting power over Uniswap’s decentralized exchange governance.

- Compound (COMP) – Enables users to vote on protocol changes in the Compound Finance lending platform.

2.3.8 Central Bank Digital Currencies (CBDCs)

- Government-backed digital currencies that function as a digital version of fiat money.

- Unlike decentralized cryptocurrencies, CBDCs are issued and controlled by central banks.

- Examples of CBDC projects:

- China’s Digital Yuan (e-CNY) – A national digital currency undergoing large-scale testing.

- Europe’s Digital Euro – Being explored by the European Central Bank.

2.3.9 Non-Fungible Tokens (NFTs)

- Unique digital assets that represent ownership of virtual or physical items like art, music, and real estate.

- Built on Ethereum’s ERC-721 and ERC-1155 standards, NFTs have revolutionized digital ownership.

- Popular NFT marketplaces include OpenSea, Rarible, and Foundation.

2.3.10 DeFi Tokens

- Used within Decentralized Finance (DeFi) platforms, enabling financial services without banks.

- Examples:

- Aave (AAVE) – A lending and borrowing protocol.

- Maker (MKR) – Helps maintain the stability of the Dai stablecoin.

Comparison Table: Different Types of Cryptocurrencies

| Type of Cryptocurrency | Example | Purpose |

|---|---|---|

| Bitcoin (BTC) | Bitcoin | Store of value, digital gold |

| Smart Contract Platforms | Ethereum (ETH), Cardano (ADA) | Power decentralized applications (DApps) |

| Stablecoins | Tether (USDT), USDC | Minimize price volatility |

| Privacy Coins | Monero (XMR), Zcash (ZEC) | Enhance transaction anonymity |

| Meme Coins | Dogecoin (DOGE), Shiba Inu (SHIB) | Community-driven tokens, often speculative |

| Utility Tokens | Binance Coin (BNB), Chainlink (LINK) | Provide services within a blockchain ecosystem |

| Governance Tokens | Uniswap (UNI), Compound (COMP) | Allow users to vote on protocol changes |

| CBDCs | Digital Yuan, Digital Euro | Government-backed digital currency |

| NFTs | Bored Ape Yacht Club (BAYC), CryptoPunks | Represent ownership of unique digital assets |

| DeFi Tokens | Aave (AAVE), Maker (MKR) | Facilitate financial services on blockchain |

With thousands of cryptocurrencies available, each plays a role in the evolving digital economy. Whether used for payments, investments, governance, or financial applications, cryptocurrencies continue to reshape the way people interact with money.

3. Why Cryptocurrency Matters

3.1 Benefits of Cryptocurrency

Cryptocurrency offers advantages that traditional financial systems often fail to provide:

- Decentralization: Reduces reliance on banks and governments, giving people more control over their money.

- Low Transaction Fees: Cross-border transactions are cheaper and faster compared to traditional banking systems.

- Security & Transparency: Immutable blockchain records prevent fraud and unauthorized alterations.

- Financial Inclusion: Provides banking solutions to unbanked populations, especially in developing countries.

- Ownership & Privacy: Users have full control over their assets without needing intermediaries like banks.

3.2 Risks and Challenges

Despite its potential, cryptocurrency is not without risks:

- Volatility: Prices can fluctuate dramatically, making investments risky.

- Security Threats: Hacking, phishing, and scams are prevalent in the crypto space.

- Regulatory Issues: Governments worldwide are still debating crypto laws, leading to uncertainty in adoption and use.

- Lack of Consumer Protection: Transactions are irreversible, which means there’s little recourse in case of fraud.

- Complexity: For beginners, understanding wallets, exchanges, and private keys can be overwhelming.

3.3 Cryptocurrency vs. Traditional Money

| Feature | Cryptocurrency | Traditional Money |

|---|---|---|

| Control | Decentralized | Centralized |

| Transaction Speed | Instant to minutes | Hours to days |

| Inflation Risk | Limited supply (BTC) | Controlled by central banks |

| Privacy | Anonymous transactions | Linked to identity |

| Acceptance | Growing but limited | Widely accepted |

Cryptocurrency is gradually shaping the future of finance by offering innovative solutions while presenting new challenges that need careful consideration.

4. Getting Started with Cryptocurrency

Entering the world of cryptocurrency can seem overwhelming at first, but with the right guidance, it becomes much more manageable. Whether you’re looking to buy, store, or use digital currencies in everyday life, this section will walk you through the essential steps.

4.1 How to Buy Cryptocurrency

Buying cryptocurrency is easier than ever, thanks to user-friendly platforms and multiple payment options. Here’s a step-by-step guide to help you make your first crypto purchase:

- Choose a Cryptocurrency Exchange

- A cryptocurrency exchange is an online platform where you can buy, sell, and trade digital assets. Some of the most reputable exchanges include:

- Sign Up and Verify Your Identity (KYC Process)

- Most exchanges require you to create an account and verify your identity through a process known as Know Your Customer (KYC). This typically involves submitting a government-issued ID, proof of address, and sometimes a selfie verification.

- Deposit Funds into Your Account

- Once verified, you need to add funds to your exchange account. Common deposit methods include:

- Bank transfers (ACH, SEPA, Wire transfers)

- Credit or debit cards

- PayPal or other online payment services

- Peer-to-peer (P2P) transactions

- Once verified, you need to add funds to your exchange account. Common deposit methods include:

- Purchase Your Desired Cryptocurrency

- After funding your account, you can now buy cryptocurrency. You can either:

- Buy at market price – Instantly purchase at the current rate.

- Set a limit order – Specify the price at which you want to buy and wait for the market to reach that price.

- Use dollar-cost averaging (DCA) – Invest a fixed amount regularly to mitigate market volatility.

- After funding your account, you can now buy cryptocurrency. You can either:

- Transfer Your Crypto to a Secure Wallet

- For security reasons, it’s best not to leave large amounts of cryptocurrency on an exchange. Instead, transfer them to a secure crypto wallet (explained in the next section).

4.2 Storing Your Cryptocurrency: Wallets Explained

A cryptocurrency wallet is essential for managing and securing your digital assets. There are two main types:

Hot Wallets (Online Wallets)

Hot wallets are connected to the internet, making them convenient for frequent transactions but also more vulnerable to hacks. Examples include:

- Exchange wallets – Provided by crypto exchanges (e.g., Binance Wallet, Coinbase Wallet).

- Software wallets – Apps like MetaMask, Trust Wallet, and Exodus offer user-friendly mobile and desktop solutions.

- Web wallets – Browser-based wallets like MyEtherWallet allow easy access without downloads.

Cold Wallets (Offline Wallets)

Cold wallets store crypto offline, offering better security against hacks and cyber threats. Types include:

- Hardware wallets – Physical devices like Ledger Nano X and Trezor that securely store private keys.

- Paper wallets – A printed version of your private key and wallet address, kept safe from digital threats.

Choosing the Right Wallet

| Feature | Hot Wallet | Cold Wallet |

|---|---|---|

| Security | Moderate | High |

| Accessibility | Instant | Requires connection |

| Best for | Frequent trading | Long-term storage |

| Examples | Trust Wallet, MetaMask | Ledger Nano X, Trezor |

For maximum security, consider using a combination of both hot and cold wallets based on your needs.

4.3 How to Use Cryptocurrency in Daily Life

Cryptocurrency isn’t just for investing—it has practical use cases in everyday life. Here’s how you can incorporate digital assets into your routine:

1. Shopping with Cryptocurrency

Many online and physical stores now accept Bitcoin (BTC) and other cryptocurrencies as payment. Major retailers, including Microsoft, Overstock, and some Starbucks locations, allow crypto transactions. Payment platforms like BitPay and Crypto.com Visa cards also enable users to spend their crypto at regular stores.

2. Sending Money Across Borders (Remittances)

Cryptocurrency provides a fast and cost-effective way to send money internationally. Traditional banking systems can take days and charge high fees, whereas crypto transactions are typically completed within minutes at a fraction of the cost. Stablecoins like USDT and USDC are commonly used for remittances due to their price stability.

3. Investing, Staking, and Earning Passive Income

Beyond holding crypto as an investment, you can put your digital assets to work:

- Staking – Earn rewards by locking up crypto to support blockchain networks (e.g., Ethereum, Cardano).

- Yield farming – Provide liquidity on decentralized finance (DeFi) platforms like Aave and Uniswap in exchange for interest.

- Crypto lending – Platforms like BlockFi and Nexo let you earn interest by lending out your holdings.

4. Traveling with Cryptocurrency

You can book flights, hotels, and rental cars using crypto through services like Travala and CheapAir. This eliminates foreign exchange fees and makes travel more seamless.

5. Donating and Supporting Charities

Many nonprofits, such as the Red Cross and Save the Children, accept cryptocurrency donations, providing a transparent and borderless way to contribute to global causes.

5. Investing and Trading Cryptocurrency

The world of cryptocurrency offers a variety of opportunities for investors and traders alike. While some view crypto as a revolutionary asset class with the potential for high returns, others recognize its risks due to extreme volatility. Whether you’re looking for long-term investment strategies or short-term trading opportunities, understanding the fundamentals is key.

5.1 Cryptocurrency as an Investment

Cryptocurrency has gained traction as a new asset class, often compared to traditional investments like stocks, bonds, and commodities. However, investing in crypto is unique due to its decentralized nature, high volatility, and evolving regulatory landscape.

Why Invest in Cryptocurrency?

- Potential for High Returns – Many early adopters of Bitcoin and Ethereum saw significant gains as the value of these assets skyrocketed.

- Diversification – Crypto provides an alternative to traditional markets, allowing investors to spread risk.

- Hedge Against Inflation – Some cryptocurrencies, like Bitcoin, have a fixed supply, making them appealing as a hedge against inflation.

- Access to Innovative Technologies – Investing in crypto projects supports blockchain innovation, decentralized finance (DeFi), and non-fungible tokens (NFTs).

Risks of Crypto Investment

- Price Volatility – Cryptocurrencies experience drastic price fluctuations, leading to potential losses.

- Regulatory Uncertainty – Government policies on cryptocurrency vary worldwide and can impact market conditions.

- Security Risks – Hacks, scams, and phishing attacks pose threats to crypto holders.

Investment Approaches:

- Long-Term Holding (HODLing) – Investors buy and hold cryptocurrencies for years, believing in their long-term value growth.

- Dollar-Cost Averaging (DCA) – Investing a fixed amount at regular intervals to mitigate the impact of volatility.

- Staking and Yield Farming – Earning passive income by locking up crypto in staking protocols or DeFi platforms.

5.2 Trading Strategies for Beginners

Cryptocurrency trading involves buying and selling digital assets to profit from price movements. Unlike traditional markets, crypto trading occurs 24/7, allowing traders to engage at any time.

Popular Trading Strategies:

- Day Trading

- Buying and selling crypto within a single day.

- Requires technical analysis skills and quick decision-making.

- High potential rewards but also high risk.

- Swing Trading

- Holding crypto for days or weeks to capitalize on short-term trends.

- Combines technical and fundamental analysis to predict price movements.

- Less stressful than day trading but still requires market monitoring.

- Scalping

- Making multiple small trades throughout the day to earn quick profits.

- Requires deep market knowledge and high-frequency trading skills.

- HODLing (Hold On for Dear Life)

- A long-term investment strategy where traders buy crypto and hold through market fluctuations.

- Based on the belief that prices will rise over time despite short-term volatility.

- Arbitrage Trading

- Exploiting price differences across different exchanges by buying low on one platform and selling high on another.

- Requires speed and knowledge of exchange fees.

Essential Trading Tools:

- Technical Analysis – Using charts, indicators (like RSI and MACD), and trend analysis.

- Fundamental Analysis – Researching projects, news, and market trends before making decisions.

- Stop-Loss Orders – Setting automatic sell points to minimize losses.

- Risk Management – Never investing more than you can afford to lose.

5.3 Taxation and Legal Considerations

Cryptocurrency taxation and regulations vary significantly by country. Some governments treat crypto as a digital asset, while others classify it as a form of currency. Understanding the legal implications of trading and investing in crypto is crucial.

How is Cryptocurrency Taxed?

- Capital Gains Tax – Applied when selling crypto for a profit.

- Income Tax – Crypto earned from staking, mining, or rewards may be considered taxable income.

- Transaction Reporting – Some governments require investors to report crypto transactions for tax purposes.

Legal Considerations:

- Government Regulations – Some countries, like the U.S. and Canada, regulate cryptocurrency, while others, like China, have strict bans.

- KYC and AML Compliance – Many exchanges require users to verify their identity under Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

- Decentralized Finance (DeFi) Risks – Some DeFi platforms operate in a legal grey area, posing risks to investors.

Before investing or trading, always consult a tax professional and check your country’s crypto regulations to ensure compliance.

Cryptocurrency offers immense investment and trading opportunities, but success requires research, strategy, and risk management. Whether you’re a long-term investor or a short-term trader, understanding the risks and legal landscape is essential for navigating the crypto market effectively.

6. The Future of Cryptocurrency

The cryptocurrency industry is rapidly evolving, driven by technological advancements, increasing adoption, and shifting regulatory landscapes. As new innovations emerge, the future of cryptocurrency holds exciting possibilities that could reshape global finance, digital ownership, and everyday transactions.

6.1 Emerging Trends in Crypto

Several key trends are shaping the future of cryptocurrency, influencing its adoption, use cases, and regulatory framework.

1. Decentralized Finance (DeFi) Revolution

DeFi is transforming traditional financial systems by offering decentralized alternatives to banking, lending, and investing. Instead of relying on banks or financial institutions, DeFi operates on blockchain networks, allowing users to access financial services without intermediaries.

- Key Features of DeFi:

- Smart contracts automate lending, borrowing, and trading.

- Users can earn passive income through staking and yield farming.

- Decentralized exchanges (DEXs) provide trading without centralized control.

- Challenges:

- Security risks, including smart contract vulnerabilities.

- Regulatory uncertainty in many countries.

2. Non-Fungible Tokens (NFTs) and Digital Ownership

NFTs have introduced a new way to prove ownership of digital assets. These unique, blockchain-based tokens are used in art, gaming, entertainment, and even real estate.

- Use Cases of NFTs:

- Digital art and collectibles (e.g., Bored Ape Yacht Club, CryptoPunks).

- Virtual real estate in the metaverse (e.g., Decentraland, The Sandbox).

- Tokenized real-world assets, such as real estate and music rights.

- Future of NFTs:

- Expansion into legal contracts and identity verification.

- Integration with gaming and virtual economies.

3. Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring CBDCs—digital versions of national currencies issued by central banks. Unlike cryptocurrencies, CBDCs are centralized and regulated.

- Benefits of CBDCs:

- Faster and more secure transactions.

- Increased financial inclusion for unbanked populations.

- Reduced reliance on cash.

- Challenges:

- Privacy concerns due to centralized control.

- Potential disruption to commercial banks.

4. Layer 2 Scaling Solutions and Blockchain Upgrades

Scalability remains a major challenge for blockchains like Bitcoin and Ethereum. Layer 2 solutions are designed to improve transaction speed and reduce fees.

- Examples of Layer 2 Technologies:

- Lightning Network (Bitcoin): Enables fast, low-cost Bitcoin transactions.

- Polygon (Ethereum): Reduces congestion and lowers transaction costs.

- Rollups: Bundle multiple transactions to improve efficiency.

5. AI and Blockchain Integration

The convergence of artificial intelligence (AI) and blockchain is leading to smarter, more efficient decentralized applications (DApps). AI-driven smart contracts and predictive analytics are being explored for trading, fraud detection, and decentralized decision-making.

6.2 Can Cryptocurrency Replace Traditional Money?

Cryptocurrency adoption is steadily increasing, but replacing traditional fiat money presents significant challenges. While Bitcoin and stablecoins are being used for payments and remittances, widespread use as a primary currency faces hurdles.

Factors Supporting Crypto Adoption:

- Financial Inclusion: Cryptocurrencies offer banking services to the unbanked, particularly in developing nations.

- Lower Transaction Costs: Crypto transactions can be cheaper than traditional banking fees, especially for cross-border payments.

- Decentralization: Reduces reliance on centralized financial institutions.

Challenges and Barriers to Full Replacement:

- Regulatory Uncertainty: Many governments are still formulating crypto policies, with some banning or restricting usage.

- Scalability Issues: Networks like Bitcoin and Ethereum face transaction speed limitations, making large-scale adoption difficult.

- Volatility: Price fluctuations make cryptocurrencies less practical for everyday transactions.

- Energy Consumption: Some blockchain networks, like Bitcoin, require high energy usage, raising environmental concerns.

Possible Future Scenarios:

- Coexistence with Fiat Currencies: Instead of replacing traditional money, crypto may complement existing financial systems through stablecoins and CBDCs.

- Mass Adoption of Stablecoins: If widely regulated, stablecoins could become mainstream payment options.

- Nationwide Crypto Adoption: Some countries, like El Salvador, have already made Bitcoin legal tender, setting a precedent for future adoption.

While cryptocurrency is unlikely to replace traditional money entirely in the near future, it is steadily reshaping the financial landscape, driving innovation, and offering new economic opportunities.

Final Thoughts: Should You Get Into Cryptocurrency?

Cryptocurrency represents one of the most significant financial innovations of the 21st century, offering a decentralized alternative to traditional money and investment opportunities beyond conventional markets. However, like any emerging technology, it comes with both rewards and risks.

The Case for Getting Into Cryptocurrency

If you’re considering entering the crypto space, here are some potential benefits:

- Financial Growth Opportunities – Cryptocurrencies like Bitcoin and Ethereum have historically provided high returns for long-term investors, despite volatility.

- Decentralization and Control – Unlike traditional banking systems, crypto allows users to have full control over their assets without intermediaries.

- Diverse Investment Options – From long-term holding (HODLing) to trading, staking, and decentralized finance (DeFi), there are multiple ways to engage with cryptocurrency.

- Innovation and Emerging Technology – Crypto is at the forefront of digital finance, smart contracts, and blockchain applications in various industries.

The Risks and Challenges to Consider

Before getting involved, it’s crucial to understand the risks:

- Market Volatility – Cryptocurrency prices can fluctuate dramatically, leading to potential losses.

- Regulatory Uncertainty – Governments worldwide are still developing regulations, which may impact crypto adoption and trading.

- Security Threats – Hacking, scams, and phishing attacks are prevalent; losing access to your private key means losing your funds permanently.

- Complexity and Learning Curve – Unlike traditional investments, crypto requires understanding blockchain technology, wallets, and transaction processes.

Best Practices for Entering the Crypto Space

If you decide to invest or use cryptocurrency, follow these essential steps:

- Educate Yourself – Learn about blockchain technology, different cryptocurrencies, and market trends before making any financial commitments.

- Start Small – Invest only what you can afford to lose, especially if you’re new to crypto.

- Choose a Secure Wallet – Use a reputable crypto wallet to store your assets safely. Cold wallets (offline storage) offer the highest security.

- Stay Updated – Follow news, regulatory changes, and emerging trends to make informed decisions.

- Use Secure Exchanges – Trade on well-established, secure cryptocurrency exchanges with strong security measures.

- Be Cautious of Scams – Avoid schemes that promise guaranteed returns, as crypto markets are inherently unpredictable.

Conclusion: Is Crypto Right for You?

Cryptocurrency is a groundbreaking financial tool that has the potential to reshape global finance. While it offers exciting opportunities, it is not for everyone. Whether you should get into crypto depends on your risk tolerance, investment goals, and willingness to learn. By taking a responsible and informed approach, you can navigate the world of cryptocurrency safely and strategically.

Frequently Asked Questions (FAQs) About Cryptocurrency

1. Is cryptocurrency legal?

Cryptocurrency legality depends on the country you are in. Some nations, like the United States, Canada, and most of Europe, fully support and regulate cryptocurrency trading and investments. Others, such as China and Algeria, have banned or severely restricted its use. Many countries fall somewhere in between, with evolving regulations.

Before investing in crypto, it’s essential to check your country’s laws and any tax obligations that come with owning digital assets.

2. Can I lose all my money in crypto?

Yes, there is a risk of losing your entire investment in cryptocurrency. Here’s why:

- Market Volatility – Crypto prices can rise or fall dramatically within hours or days, leading to significant losses.

- Hacking and Security Threats – If your crypto exchange or wallet gets hacked, you could lose your funds.

- Lost Private Keys – Unlike a bank, there’s no way to recover lost crypto if you forget your private key.

- Scams and Fraud – Fake investment schemes, phishing attacks, and rug pulls are common in the crypto world.

To minimize risks, invest only what you can afford to lose, use secure wallets, and follow best security practices.

3. What is the best cryptocurrency for beginners?

For those new to cryptocurrency, it’s best to start with well-established and widely used digital currencies, such as:

- Bitcoin (BTC) – The first and most valuable cryptocurrency, often referred to as “digital gold.” It is widely accepted and relatively stable compared to smaller coins.

- Ethereum (ETH) – Offers more than just a currency; it powers smart contracts and decentralized applications (DApps). It is a strong choice for those interested in blockchain technology beyond just payments.

Other beginner-friendly options include:

- Stablecoins (e.g., USDT, USDC, BUSD) – These have a stable value pegged to fiat currencies, reducing volatility.

- Binance Coin (BNB) – Popular for trading on Binance and earning transaction discounts.

4. How do I safely store my cryptocurrency?

To protect your crypto assets, consider these wallet options:

- Hot Wallets (Online Wallets) – Convenient for quick access but vulnerable to hacking (e.g., MetaMask, Trust Wallet).

- Cold Wallets (Offline Wallets) – Best for long-term storage with high security (e.g., Ledger, Trezor hardware wallets).

- Paper Wallets – A physical printout of your private and public keys, keeping your assets offline.

For maximum security, use a combination of hot and cold wallets, enable two-factor authentication (2FA), and avoid storing large amounts of crypto on exchanges.

5. Can I use cryptocurrency for everyday purchases?

Yes, but it depends on where you are and the businesses around you. Many companies and online stores now accept crypto payments, including:

- Retailers – Some brands like Microsoft, Overstock, and Newegg accept Bitcoin payments.

- Travel & Hospitality – Airlines, hotels, and travel agencies like Travala.com allow crypto payments.

- Gift Cards – You can buy gift cards with crypto and use them at mainstream stores.

However, cryptocurrency adoption is still growing, and not all merchants accept it. Some crypto debit cards, like those from Binance or Crypto.com, allow users to spend crypto anywhere Visa or Mastercard is accepted.

6. How do I start trading cryptocurrency?

To begin crypto trading, follow these steps:

- Choose a Cryptocurrency Exchange – Platforms like Binance, Coinbase, and Kraken are popular choices.

- Create an Account – Register, complete identity verification (KYC), and secure your account with 2FA.

- Deposit Funds – Add money via bank transfer, credit card, or crypto deposits.

- Select a Trading Pair – Choose a cryptocurrency to trade, such as BTC/USD or ETH/USDT.

- Use Trading Strategies – Decide between day trading, swing trading, or long-term investing (HODLing).

- Manage Risks – Set stop-loss orders and only invest what you can afford to lose.

7. Do I have to pay taxes on cryptocurrency?

Yes, in most countries, cryptocurrency is subject to taxation. Common tax categories include:

- Capital Gains Tax – If you sell crypto for a profit, you may owe taxes on the gains.

- Income Tax – If you earn crypto through mining, staking, or airdrops, it may be considered taxable income.

- Transaction Tax – Some jurisdictions impose taxes when you use crypto for purchases.

Tax regulations vary widely, so consult a tax professional or check your local tax authority for accurate guidance.

8. What are the biggest risks in cryptocurrency?

While cryptocurrency offers many opportunities, the biggest risks include:

- Regulatory Crackdowns – Governments may impose strict regulations or bans on crypto trading.

- Scams and Frauds – Fake ICOs, Ponzi schemes, and phishing attacks are common threats.

- Liquidity Issues – Some smaller or lesser-known cryptocurrencies may lack buyers, making it hard to sell.

- Smart Contract Bugs – Errors in DeFi projects and smart contracts can lead to financial losses.

Always research thoroughly before investing and avoid projects that seem too good to be true.

9. What is the difference between cryptocurrency and blockchain?

- Cryptocurrency is a digital asset used as a medium of exchange, store of value, or investment. Bitcoin, Ethereum, and stablecoins are examples.

- Blockchain is the underlying technology that enables cryptocurrencies to function. It is a decentralized, immutable ledger that records transactions transparently and securely.

While cryptocurrency is one application of blockchain, the technology itself has many other uses, including supply chain management, healthcare, voting systems, and digital identity verification.

10. What happens if I lose my private key?

Losing your private key is one of the biggest risks in cryptocurrency. If you lose it, you permanently lose access to your funds. There is no recovery option like a password reset in traditional banking.

To prevent this:

- Store your private keys in multiple secure locations.

- Use hardware wallets or paper backups.

- Consider using a multi-signature wallet that requires multiple approvals to access funds.

Some wallet providers offer recovery phrases (seed phrases) that can help you regain access if your private key is lost. Keep this phrase safe and never share it with anyone.

11. Is cryptocurrency a good investment?

Cryptocurrency can be a good investment, but it depends on your financial goals and risk tolerance. Many investors have made significant profits, but others have suffered losses due to market volatility.

- Long-term investors (HODLers) may benefit from price appreciation over time.

- Traders can take advantage of market fluctuations for short-term gains.

- Diversification is key—never invest all your money into one asset.

Since crypto is highly speculative, always conduct thorough research and never invest more than you can afford to lose.

12. Will cryptocurrency replace traditional money?

While cryptocurrency adoption is growing, it is unlikely to completely replace traditional fiat currencies in the near future. Challenges include:

- Regulatory Uncertainty – Governments still control national currencies and monetary policies.

- Scalability Issues – Many blockchains struggle to process transactions as quickly as credit card networks.

- Public Adoption – Not everyone is comfortable using crypto, and businesses may be slow to accept it.

However, crypto is becoming more integrated into the financial system, with increasing use cases in payments, banking, and international transfers.

Final Thoughts

Cryptocurrency is an exciting and evolving industry, but it requires careful research and risk management. Whether you’re looking to invest, trade, or use crypto in daily life, staying informed and secure is the key to success.